- About UPF-BSM

- Programs

- Faculty and research

- Companies and Organizations

- News & Events

Financial institutions and sustainable development goals

6 Febrero - 2023

Marcos Eguiguren Huerta

Associate Provost for Strategic Projects

Director of the International Chair in Sustainable Finance UPF-BSM & Triodos

__

The COP27 meeting, held in November last year in Egypt, passed almost unnoticed, with little substantial progress in the much-needed global coordination of the fight against one of the most serious challenges ever faced by humanity, climate change and its effects on life on our planet.

Despite this, with so many days of meetings, conventions, parallel meetings, etc., there are always interesting points that come up. As an example, in the shadow of COP 27, we attended the presentation of the conclusions of the 2022 Financial System Benchmark, which analyses the 400 most important global financial institutions in the world to assess how prepared they are to face the transformation towards a model of sustainability and to ensure that they are carrying out an asset distribution policy that better represents the risks and opportunities linked to the limits of the planet and to social conventions.

The 2022 Financial System Benchmark analyses the 400 most important global financial institutions in the world to assess how prepared they are to face the transformation towards a model of sustainability.

We will not go into detail about the methodology used, as this would greatly exceed the scope of this brief review, but we will point out that the rating given to each institution is based 40% on indicators of inclusiveness and impact policies in the field of governance and strategy, 30% on indicators of how the entity respects the limits of the planet, both in the field of climate change and in that of respect for nature and biodiversity, and the remaining 30% on indicators of how the entity adheres to the main social conventions in areas such as respect for human rights, ethical action and corporate policies, and the ability to provide decent work.

It seems that this is a fairly sensible benchmark that can reflect reasonably well the reality of how financial institutions are effectively trying to contribute to the achievement of the Sustainable Development Goals (SDGs). The main conclusions of the study, however, could not be more disheartening.

There is a long way to go: little recognition, a lack of commitment and impact analysis, useless processes

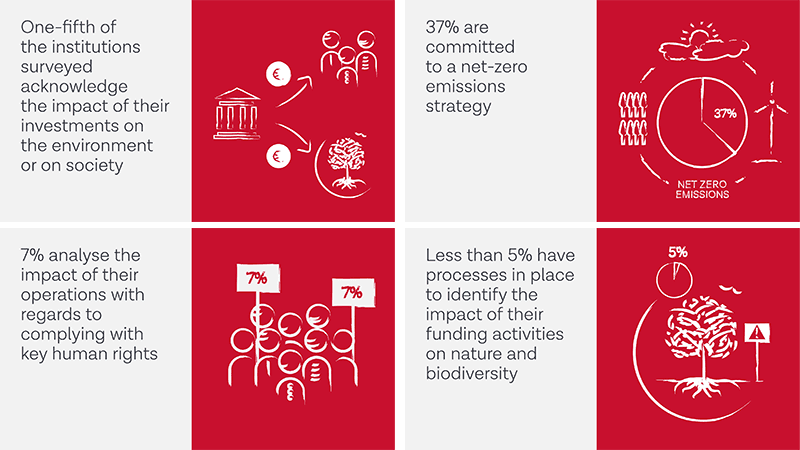

Firstly, most institutions do not recognize the impact of their investments on the environment or on society. Only one-fifth recognize these impacts and give some information about them.

Secondly, commitment to a strategy for reducing emissions to net zero remains low; only 37% of entities have published some type of strategy or long-term objective in this regard. Unfortunately, only 2% of institutions have published intermediate objectives to help track progress.

Thirdly, impact analysis of the risk related to non-compliance with key human rights is practically non-existent. Only 7% of entities publish it regarding their own operations and 3% with regard to the activities they finance. With this data it is impossible to verify whether the entities are fulfilling their theoretical role of encouraging those businesses that operate in a more ethical way, at least at a basic level.

Fourthly, funding for low-income countries, small and medium-sized enterprises, and groups at risk of exclusion is extremely low or unreported.

Finally, most financial institutions, less than 5% of those analysed, do not have processes for identifying the impact of their financing activities on nature and biodiversity.

Of the 400 entities analysed, only three pass the benchmark, and then only just. The highest rated entity, a Canadian bank, scores 52.5 out of 100

There is a lot that can be improved, without a doubt, among the large global financial institutions. Of the 400 entities analysed, only three pass the benchmark, and then only just. The highest rated entity, a Canadian bank, scores 52.5 out of 100.

If we look at the situation of the Spanish financial institutions subjected to analysis, on the one hand, we have the good news that all of them are above the average of the 400 institutions analysed, the result of a clear effort to improve, but on the negative side it should be noted that their scores range between 16.1 and 37.1 out of a maximum of 100, far from passing and with a huge amount of room for improvement.

There is no time for complacency. In this and any other rating that measures the finance world's commitment to the SDGs, the only thing we expect to see is a rapid improvement in the role finance is playing in transforming the economy. We will be keeping an eye out for upcoming benchmarks and new publications of comparative studies.

The time for greenwashing is behind us.