- About UPF-BSM

- Programs

- Faculty and research

- Companies and Organizations

- News & Events

Real threats to traditional banking from bigtechs

11 Enero - 2022

David Igual

Lecturer at Finance, Accounting & Controlling Dept.

__

The term bigtech is well known to all to identify large technology companies that accumulate characteristics that are shaping a new economy and that set the course for any business activity that wants to survive in the new digital era: globalization, intensive use of data, use of new exponential technologies, huge number of users, high capitalization, good image, care of the customer experience...

Bigtech is shaping a new economy that is setting the course for any business that wants to survive in the new digital era.

However, the most relevant aspect of the bigtech business model is the so-called "network effects" and "intertwining of activities". The first example allows users to benefit from access to a platform in which more and more users participate (larger than Marketplace) and which allows new technologies to be applied. The second case consists in offering complementary services that are useful and easily accessible thanks to the knowledge of customers. The analysis of these elements explains the growth of these companies and their ability to dominate entire sectors such as advertising, travel, access to information, e-commerce, entertainment and many others.

Doing finance without being a bank

The impact of bigtechs on finance and the challenge that their activity poses to traditional banking is often discussed. This is also often discussed from the banks' point of view, with the claim that bigtechs do not want to become banks because of the tremendous regulatory burden they have to bear. In addition, the banking business is too local for global companies.

Indeed, these are obvious aspects, but it should be borne in mind that it is possible to do finance without being a bank. Amazon, for example, offers its Amazon Prime service for access to movies and series, in competition with Netflix, without being a classic television network; Google markets advertising without the format of the old advertising agencies; Apple, in addition to selling computer equipment and software, offers Apple Music, a streaming service that allows you to listen to more than 85 million songs with a model that has nothing to do with that of the old record agencies.

Bigtechs do not want to become banks due to the tremendous regulatory burden they face and the fact that the banking business is too local for global companies

All these cases show the ability of bigtechs to exploit their network effect and to intertwine activities through expansive growth that generates new activities in a disruptive way, thus destroying previous business models that served similar needs. In other words, bigtechs develop strong economies of scope in collateral activities thanks to the use of data and new technologies, replacing previous business models.

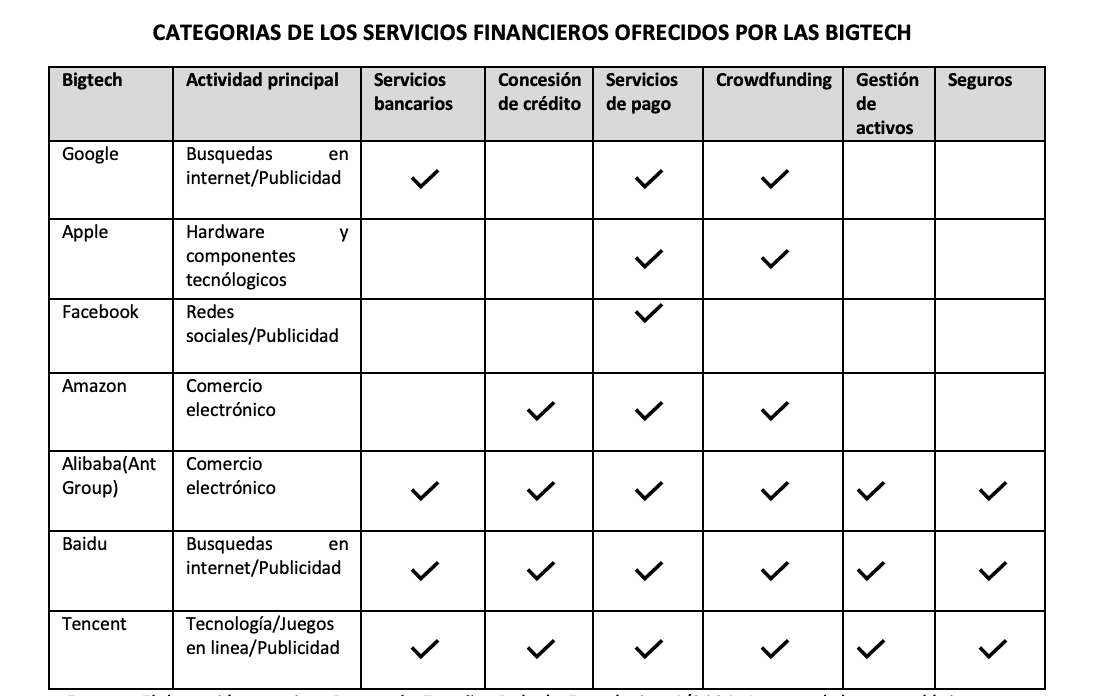

Seen in this light, it is not surprising to note that bigtechs are already using finance to reinforce their network effect or the intertwining of their activities. A review of the incursions of the various bigtechs into finance already provides us with some information:

Although the scope of action of bigtechs in finance is still limited, it can be seen that the trajectory follows a pattern that starts with payments and small credit for consumption and product acquisition, leaving insurance and savings for later stages. Nor do we see any incursions into mortgage lending or deposit management. Thus, for the time being, the experiences are focused on supporting the main activity, as well as obtaining extra income with the additional benefit of accumulating invaluable information and data on the behavior of users in finance and product consumption.

Bigtechs scoope of action

In market terms, the emergence of bigtechs offers a number of potential benefits, such as increased supply, financial inclusion and even improved financial efficiency by proposing alternatives to the banking sector's increasingly concentrated oligopoly. However, it also raises innumerable doubts and problems, both because of its market power and the loss of control by central banks over a basic part of their actions: ensuring financial stability and consumer protection. The free action of the bigtechs is outside the control of monetary policy and the control tools of the states, generating a great debate on what measures to apply and how to regulate these supranational entities.

Free action by 'bigtechs' is outside the control of monetary policy, generating a great debate on what measures to apply and how to regulate these supranational entities

Analyzing the financial activities into which bigtechs have ventured, payments stand out, in which there are two versions. On the one hand, in advanced countries with high levels of banking penetration, where bigtechs have so far used an overlay system that improves banking services. This is the case of the Google Pay wallet, which provides users with more security than credit cards themselves, although it relies on them (VISA, Mastercard) and on the bank itself to authorize transactions. It is not difficult to think that the role of credit cards can be eliminated, as some fintechs are already offering in order to reduce commissions. On the other hand, there is the version of countries with low levels of banking penetration, in which collaboration is carried out together with telephone companies without the banks taking advantage of the possibilities of technology to make these segments grow.

In both cases, the option of finally taking control of payments and relegating the role of banks is real, and the BIS itself warns of the possible future challenge by calling for a policy of control over large technology companies, pointing out that, for example, in a few years the two large technology companies in China have taken 94% of the payments activity.

In Spain, the first step in the field of credit has been taken by Amazon, which has alliances with the Cofidis group and Fintonic to allow users to defer payment of their purchases

In the area of credit, the focus is mainly on small short-term loans linked to facilitating consumption. But there are already agreements that aim more ambitiously. The presence of bigtechs in consumer credit is already very relevant in countries such as the United Kingdom or France, as well as in the United States. In these cases, although banks collaborate with bigtechs, they subordinate their role to that of financial provider. This is the case of Goldman Sachs' funding of operations for Amazon.

In Spain, the first step has been taken by Amazon, which has alliances with the Cofidis group and Fintonic to allow users to defer payment for their purchases. In this area of credit, the deferred payment business formulas known as Buy Now, Pay Later, which are used in combination by bigtech and PayPal and which banks are not yet entering. The new Open Banking regulations are also favoring the emergence of agents capable of attracting users in a process independent of loan funding, relegating banking to the role of a wholesale provider of resources.

New business lines

Other lines of business are beginning to emerge, such as insurance, trading operations or crowdfunding, where some bigtechs are experimenting with programs, but it does not seem that they can make great progress if they are not accompanied by the aforementioned network effect and the intertwining of each platform's own activities.

In conclusion, the advance of bigtechs in finance seems unstoppable and is occurring gradually, with a trajectory marked by the ability to attract new users to their platform and to offer activities that complement their core business. There are no perceptible category leaps, nor is there any intention to take on activities in the classic formats of banking structure. Their penetration in finance presents new formulas to cover financial needs without the classic banking products. One of the main challenges for banking is to fight to maintain the relationship with users and not be relegated to the role of wholesale resource provider, keeping those parts of the banking business that are not profitable or involve more risk.