- About UPF-BSM

- Programs

- Faculty and research

- Companies and Organizations

- News & Events

Decentralized finance reduces the effect of the blockade on Russia

22 Marzo - 2022

Luz Parrondo, Postgraduate course in Blockchain and other DLT technologies Director

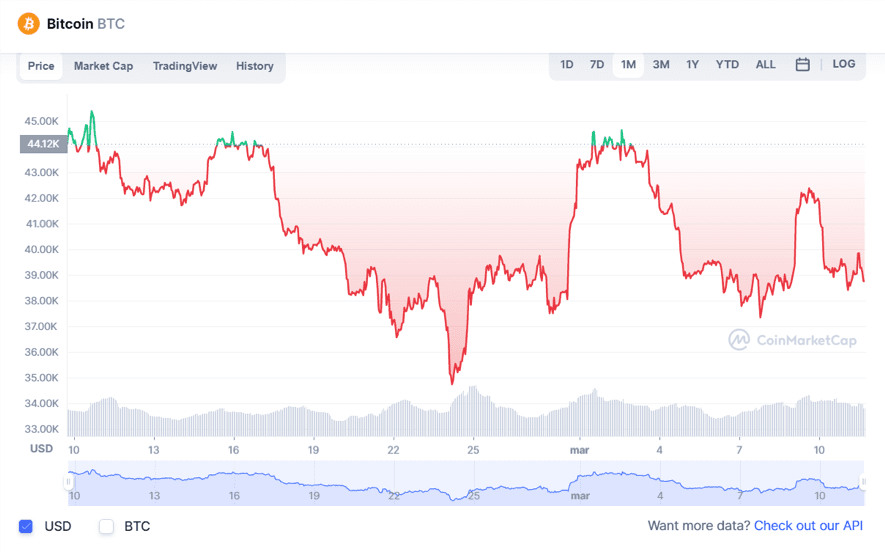

United States, Canada and Europe tightened financial restrictions on Russia in early March with a new ban that prevents seven Russian banks from using SWIFT, the global messaging system that allows banking transactions. The move is aimed at disrupting Russia's ability to do business across borders. This fact coincided with the rise in the price of bitcoin from 38,050 to 43,500 dollars which, although it has not been maintained, supports the market's perception of cryptocurrencies as an alternative to the sanctions.

This possibility did not go unnoticed by governments. In a letter to US Treasury Secretary Janet Yellen, some US politicians warned of the possibility of Russia using cryptocurrencies to circumvent economic sanctions. The reaction was immediate, with the Treasury Department setting new regulations on cryptocurrency service providers to block sanctioned entities and their addresses.

The response from Coinbase and Binance, two of the largest cryptocurrency exchanges, was that they will not impose a blanket ban on Russian citizens, but that they are willing to block trading activity by sanctioned individuals and entities. Ethereum, the blockchain platform that provides most digital financial services, has also expressed its willingness to collaborate in the blockade within its possibilities. But despite the good will of all these intermediaries, the effectiveness will not be complete due to the decentralized nature of certain ecosystems. Avivah Litan, an analyst and vice president at research firm Gartner, has stated that "no legislator or regulator can stop an on-ramp and off-ramp on an unregulated or decentralized exchange."

Exchange and decentralized networks

Bitcoin, unlike Ethereum, is a decentralized network that does not have a legal or physical person to represent it. There is no interlocutor from whom to request a block on transactions. Within these networks, actions are carried out without central governance, and therefore users circulate freely and sometimes anonymously. The weak point of this anonymity is in the exchange centers, that is, if an Exchange is used to exchange cryptocurrencies between them or for legal money. The best-known exchanges are centralized and willingly collaborate with blocking, but there are others that are not.

Russian oligarchs and large institutions can stay longer inside the crypto circuit to raise fiat money and bypass sanctions

A decentralized Exchange is similar to a vending machine. Suppose an international network of vending machines with the ability to exchange currencies for their users. These machines do not identify the customer, they only require you to enter a coin and a number to provide you with a product. In this context, limiting transactions based on provenance or identity is at best difficult if not impossible. Russian oligarchs and large institutions, the main target of sanctions, unlike the average citizen, can stay longer inside the crypto circuit without the need to access checkpoints to get fiat money and thus bypass sanctions .

While it is true that crypto-technology makes it difficult to block Russia, it has also turned out to be a great ally for Ukraine. Since the beginning of the invasion, the Ukrainian government has received external funding to support the country and its armed forces. Cryptocurrencies have proven to be one of the most effective ways to obtain funds from anywhere in the world. Even the Ukrainian deputy prime minister, Mykhailo Fedorov, has even announced the creation of NFTs to encourage donations.

Digital currencies are also effective in protecting millions of citizens who see their savings threatened. Like gold, cryptocurrencies can play the role of safe haven asset against the collapse of money and the blocking of bank accounts. Or as freedom insurance at border crossings, where 21st century refugees exchange gold and jewelry for digital assets that they store more conveniently in electronic devices (cold wallets) or in applications connected to the Internet (hot wallets), to have your cryptocurrencies anywhere without anyone being able to block it.

Like gold, cryptocurrencies can play the role of safe haven asset against the collapse of money and the blocking of bank accounts

Decentralization, understood as protecting the individual, therefore has conflicting consequences in the Russo-Ukrainian conflict. In the case of Russia, it protects the oligarchs and sanctioned institutions against the international blockade and in the case of Ukraine it provides financial aid, and protects citizens from inflation, bank collapse and expropriation. In the 21st century we replace “physical” systems with more efficient and scalable “digital” systems. This digitization facilitates and improves what has always been done. Vladimir Putin and the Kremlin have for years developed protection strategies against possible blockades: seeking commercial alliances with countries like China, accumulating reserves in yuan, gold and other alternative systems to SWIFT. Cryptocurrencies are one more option. In themselves they do not represent the worst of threats or the best of solutions, they only digitize them and make them more efficient.