Differentiation, Convenience, Customer Selection and Own-Label, New Alternatives for The Retail Sector

31 Mayo - 2023

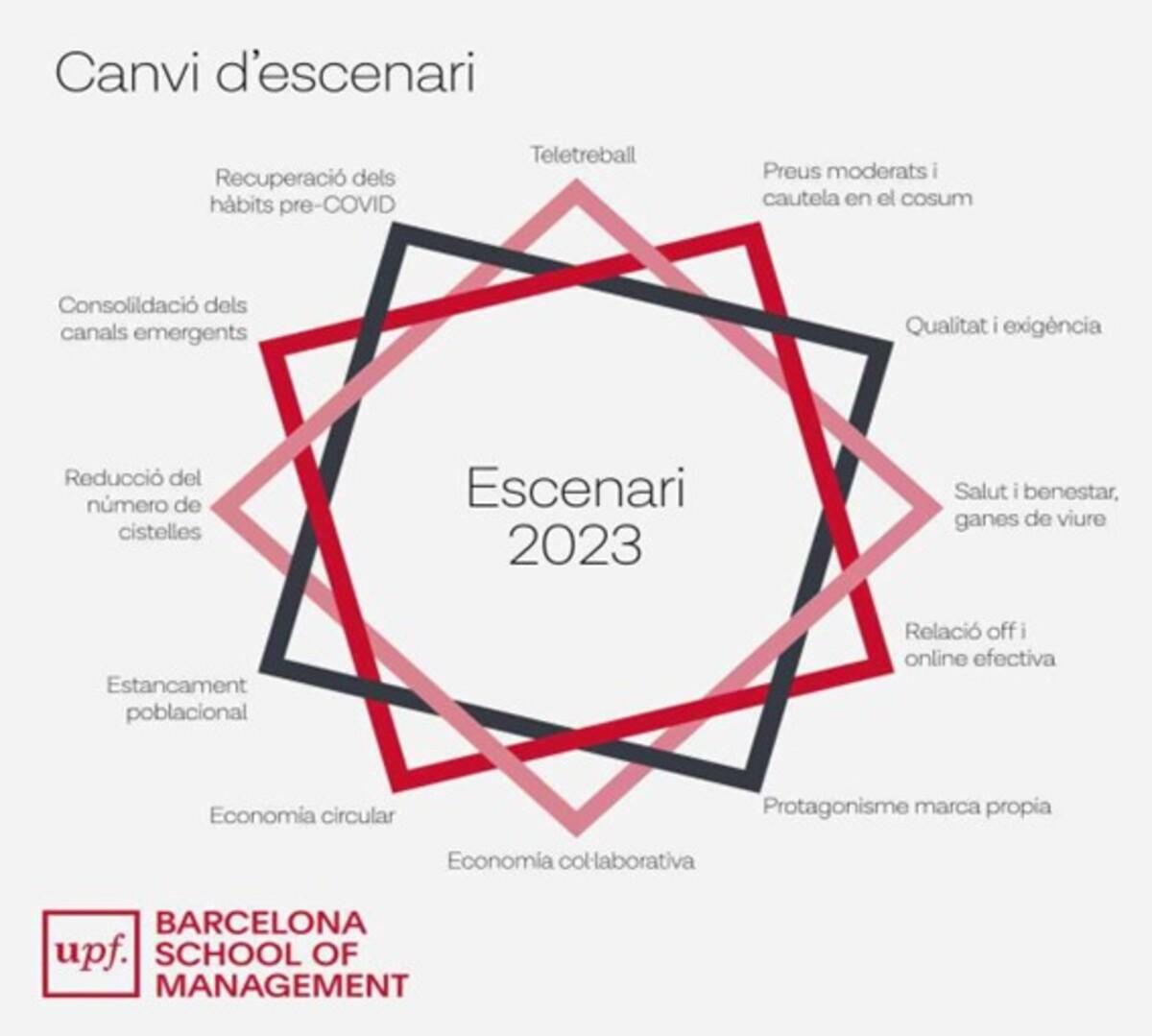

There is currently a set of factors putting pressure on the entire landscape of the retail sector. Some of these factors have been with us for a while already, such as the circular economy, the sharing economy, demand for health and wellbeing and increasingly demanding requirements in terms of quality and rigor. Other factors are a consequence of the current backdrop of high inflation, such as the predominance of own-labels and virtual communication to support in-person contact, for instance. The result is that companies’ turnover is increasing, due to inflation, but the number of units sold is on the decline.

To respond to this scenario, the report “Retail Strategies to Tackle Consumer Caution, the Quest for a new Business Model in which Price is not a Determining Factor”, written by Professor Josep-Francesc Valls and published by the UPF-BSM’s Chair in Retail, strives to reorganize these production factors, with an emphasis on the following four elements:

- Differentiation, which refers to the competitive advantage generated by digital and logistical technologies, the quality demanded by the customer, the personalization of the experience, the commitment to contemporary values, phygital communication, and affordable prices.

- Constructing and offering convenience, which entails the combination of the ranges of products and services, prices and channels, the way of delivering the goods, and the dimension of the establishment.

- Customer selection, referring to the match between the values of the manufacturers retailers, on the one hand, and of the customers, on the other, which generates trust, confidence and, therefore, satisfaction, repeat purchasing, and the maintenance and improvement of the sales margin.

- Developing the own-label, by exploring new consumption territories, catering for new trends through the range supplies, and expanding to other channels. Basing our strategies exclusively on reducing prices at times like these generates damaging effects in the medium and long term, such a reducing sales margins, the customer getting even more used to discounts, attracting the wrong customers, pushing the right customers away, and making demand unpredictable.

The report firstly studies the aspects involved in the current conundrum of retail. There is a whole series of factors that immediately put pressure on the retail sector, such as: consumers’ urgent need to regain their pre-Covid standards; remote working, which modifies the previous ratio between eating at home and eating out; the reduction in the number of shopping baskets purchased, due to inflation and demographic stagnation; and the consolidation of emerging channels resulting from digital transformation.

Other aspects also have an impact, but have been around for longer: the quality requirements and responsibility demanded by retailers; growing demands for product traceability, improved environmental criteria of the supply chain, concern for health and wellbeing, which all influence the products in the highest demand; and the balance between the in-person and virtual experience with respect to how we shop.

Although inflation is settling down and recovery periods are getting shorter in most sectors (except the food sector), we can still observe an increase in turnover, but a drop in the number of units sold. Therefore, rather than focusing exclusively on price, the abovementioned set of alternatives is proposed as a way to tackle the new situation: differentiation, convenience, customer selection and own-label.

A New Conversation between Manufacturers and Retailers

In effect, as a result of the reinvention of the supply chain through digitization, we are witnessing the emergence of a new conversation between manufacturers and retailers, and even more so between manufacturer brands and own-labels. While before the relationship between them was hierarchical, they now interact more as peers. As a consequence, the conversations between them is no longer afflicted by the traditional combative tension to forge new formulas of collaboration. They still compete with each other as far as brands as concerned, but they are opening up to:

• Achieve greater brand penetration in commercial establishments, at both a structural and product category level, both in-store and online.

• Develop joint initiatives in commercial establishments —creating themed campaigns, events, promotions, etc.—, as the most effective system that also benefits manufacturers.

• Penetrate at each moment of consumption.

With respect to increasing the value of brands, in times of inflation like these, this can only be achieved by:

• Exploring new consumption territories, beyond the usual ones.

• Intensifying all the emerging trends that appear.

• Ensuring a massive presence through digital channels

• Listening more and better to customers in order to understand their needs and aspirations more effectively.